Tag Archives: Beijing Headhunter

RMG Wechat

- Friday, 21 February 2014 06:34

Day breaks in china’s logistics industry

- Monday, 17 February 2014 07:28

MENTION logistics, and perhaps a busy port comes to mind. We may then recall how Rotterdam was unarguably once the world’s busiest port, for 40 years. Yet, in just a few years this logistical crown was usurped by Singapore, among the most thriving of countries in Asia. How is the logistic industry going on in the Chinese market? Find out in Ruben’s latest article published on China Today “Day Breaks in China’s Logistics Industry”!

The term “logistics” was first coined in 1927 by U.S. scholar Ralph Borsodi. Yet logistics services actually originated in military usage, and logistics has since come to play a major role in today’s global supply chain. Among all types of logistic services, however, third-party logistics (TPL) first started in the 1980s in the United States. This business expanded by 20 percent each year over the following 20 years. And then TPL in the European countries swiftly came up from behind.

The world was, to a large extent, then soon surprised by the rapid development of the logistics industry in China. Though the industry was exposed to a negative economic environment from 2008 to 2009, during which the world suffered the financial crisis outbreak, it was somehow a wakeup call for international logistic companies, to the fact that Asia, or more specifically China, is where the future of the industry lies.

What’s going on in the industry in Europe and the U.S.A., as compared to China’s current TPL development? There are apparently many differences.

Enormous Investment in an Emerging Industry

In terms of logistics infrastructure, since most business is done through ocean freight, differences may be illustrated by comparing the amount of investment in port infrastructure in China and Europe. After China officially became a WTO member in 2001, international TPL rushed into the Chinese market. A huge investment in China’s TPL has since been evident. In the year 2002, there were only about 10,600 quay berths, yet by 2011-2012, they had almost tripled to 31,000 (2013-2017 China Port Logistic Industry Analysis and Prediction Report data). The amount of investment has continued to increase each year. For example, after gaining great rewards in 2011, the Logistics Management Department of Liaoning Province decided to invest RMB 20 billion in port infrastructure in 2012.

Since Europe became involved in the logistics business earlier than Asian countries, as regards both infrastructure and operation of the logistics industry, European countries have achieved greater maturity. Their investment should therefore not increase as rapidly as in China. However, through specific investment in either channels or bridges to solve small problems, certain cities like Hamburg and Antwerp are still among their greatest ports in Europe. Moreover, investment in further development never stops in Europe. Rotterdam, as the best port in Europe, absorbed €10 billion (about RMB 80 billion) in investment from government and corporations from 2006 to 2013. And despite being the best in Europe, development of this port has never stopped.

Toward Lower GDP Costs

Observing the logistics costs in percentage terms of GDP in China and in some developed countries, we see there is still much to improve in China’s logistic systems. Logistics costs refer to the costs of transporting and storing products, as linked with charges for transportation methods including train, truck, air and ocean transport. Other logistics costs include fuel, warehousing space, packaging, tariffs and duties.

In 2011-2012, logistics industry costs as percentage of GDP were: U.S.A. – 10.5 percent, UK – 10.6 percent, Netherlands – 11.3 percent, and Japan – 11.4 percent. In 2011-2012 in China, logistics industry costs as a percentage of GDP was about 18 percent – 8 percent higher than in developed countries (China Logistics Club data). Further explanation is required here: lowering such costs as a percentage of GDP is more profitable for businesses. This is because logistics services do not add value to the process. To be specific, the faster and more efficient you are, the more money you make during the process. Unfortunately, an increasing number of logistics companies in China are still struggling for higher profits.

Yet, it is worth mentioning the case of Qingdao, a city doing so well in logistics that it sets a good example for other cities in China. In 2008, the cost of logistics in Qingdao was only 9.8 percent of GDP, comparable to developed countries. The city mainly developed its port, supplementing airfreight and rail transport. It has thus focused on its specialty – ocean freight. In this regard, reduction of logistics costs requires companies to specifically focus on an industry and offer proper logistics services at the same time.

Clear Norms and Standards Required

There is a famous saying among the Chinese, “Nothing is accomplished without norms and standards.” This works in the logistics industry, too. Logistics management standardization refers to national regulations and standards in the industry, the assortment of types and sizes of companies, the business process, and so forth. To manage an industry well, to a large extent, entails a well-established management system.

The United States was the first country in the world to organize a national logistics management department – the National Council of Logistics Management (CLM). In the 1980s, rules and regulations (around 1,200 terms) were drafted for airways, waterways, railways and highways, which ensured the quality of logistics services in the country. It is the same in Europe. DHL, Kuehne & Nagel, DSV, Panalpina, CEVA – all these companies are excellent performers in the market. The key reason is that people know what they are doing every day and why they do what they do. Everyone is clear about standards and norms.

As for Chinese logistics standards, of course companies must follow rules from the Ministry of Commerce, the Ministry of Transport, and the General Administration of Customs. However, these are all very general rules. And although there are local logistics organizations in China, for example, the China International Freight Forwarders Association being one of the biggest, such organizations have yet to devise specific rules. There are thus no detailed rules and regulations for Chinese logistics companies to follow.

In this regard, I have two sets of advice for Chinese logistic organizations. Firstly, I would recommend that Chinese logistics organizations, especially local ones, cooperate with each other by holding events and networking activities. In this way, logistics organizational networks would expand effectively. Through merging local logistics organizations toward a larger scale, amalgamation could approach the level of international logistics organizations. Another point is to increase standards for companies wishing to join logistics organizations. Normally companies who are members of the organization are given logistics certificates. I think if China divides the certification system into the three levels of basic, good and excellent, some truly fine logistic companies would be more willing to join such organizations.

Market Segmentation

As client needs may vary quite significantly, logistics services could be divided into many types: by industry, geographic region, product, clientele, time duration, service, and interest return. In freight forwarding, for example, the basic service is transport from port to port. Other companies offer added-value services – transport from door to door. The market is thus based on service type. Market segmentation among big international companies in Europe is fully developed. They offer services for ocean imports and exports, containers, contract logistics, and so forth. Customized services have become one of the core ideas for running businesses in today’s world. Moreover, there are logistics companies offering services to only one or a few select industries, such as in automotive and consumer products, or chemicals.

Development in China’s logistics market segmentation is still at entry level. At the beginning, a lot of logistic companies provide the same services. Problems appear at a later stage when profits begin decreasing at a rapid rate. Companies, therefore, have to think about how to make the pie bigger before getting their slice. A few of the better logistic companies, such as COSCO Logistics and CNPL, are performing well through the market segmentation process, based on geographic region, industry type, as well as the size of client companies.

The point of comparing the industry in China to that in Western countries is not to let everyone down. Though there are disadvantages for China right now, with the above improvements, business will get better sooner or later. There is no doubt that, during the past decade, the development of the logistics industry has been amazing.

When the Netherlands was still king of the logistics industry, Asian ports and logistics companies were left far behind. China took but a few years to catch up, and then take the lead. With the country’s rapid economic growth, I am confident that China will unleash a logistics industry gold-rush in the near future. RUBEN VAN DEN BOER is RMG Selection consultant.

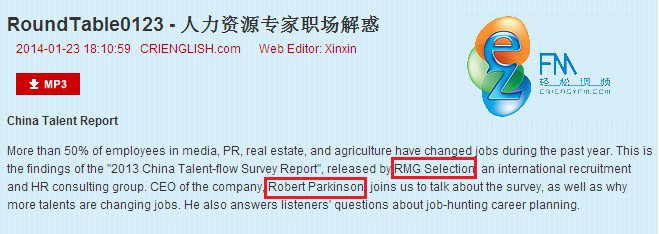

Robert on Easy FM Round Table show talking about Job Market

- Tuesday, 28 January 2014 01:06

CEO of RMG Selection, Robert Parkinson, joins Easy FM Round Table show to talk about Job Market as well as the findings of the “2013 China Talent-flow Survey (TFS2)” released by our company. He also answers listeners’ questions about job-hunting career planning. In general, we have four topics in this show: 1. China Talent Report 2. Job Hopping 3. First job of college graduates 4. Changing jobs after a long holiday. Click here to find more information : http://english.cri.cn/4926/2014/01/23/1561s809663.htm

Source: http://english.cri.cn/4926/2014/01/23/1561s809663.htm

China Dream Sours for Foreign Companies- Financial Times

- Tuesday, 13 August 2013 03:37

Read the origional version at: http://www.ft.com/intl/cms/s/0/4c9d9f06-00bd-11e3-8918-00144feab7de.html

The Bull is Back! Why Hiring People Currently without a Job might be a Jolly Good Idea – Business Tianjin

- Monday, 22 April 2013 07:39

To my great relief, as the owner of a recruitment firm active throughout China, 2013 is looking like it’s going to be a good year: The Europeans seem to have adverted the ‘nuclear’ scenario being touted last year of a multi-country Euro exit (there are even positive noises about Greece’s economy now); the Britons and the Germans seems to be talking sense over the EU budget; the stock markets around the world have rallied so far in 2013; Obama is pursuing a growth agenda alongside encouraging data coming out of the US and there seems to be increasingly and repeatedly positive news about the state of the Chinese economy; albeit with simmering concerns over local government debt.

We can, therefore, take comfort in the fact that there is at least some good news for the average white-collar professional working in China (unless you’re a banker), as the renewed confidence in the economy translates into greater hiring numbers; particularly in mission critical / demand-creation roles. I would expect this confidence to grow quite considerably in Q3 & 4 of 2013. So with this likely need to hire, I’d like to offer a different perspective on taking on hiring individuals who are currently not in work.

Traditionally, there has been an assumption amongst many executives that those not in work are in some way tarnished, and therefore to be avoided (I know this having talked about it to thousands of clients over the last 15 years in many different countries). An assumption that their lack of work is in somewhat related to poor performance either directly or indirectly, and ‘they’ are therefore ‘best’ avoided. Maybe a reasonable assumption in a developed economy, not so here!

Let me present to you the current scenario in mainland China, and then some reasons why it might just be the best thing you’ve ever done to hire someone who’s not working:

Firstly, the Chinese situation at present: The ratio of cost of living to income amongst affluent, educated professional people is just about the highest I have seen anywhere in the world. What I mean is this, although yes, food prices have risen of late, the cost of food, particularly when consumed in restaurants, is tiny compared to the average professional’s income. You can eat well, with wine for CNY 200, (USD 30) whereas the same would cost you 4 times that in major western cities. My car (a ‘full-sized’) costs me CNY 400 to fill up in Beijing, whereas in London my (by comparison) tiny VW Polo costs me CNY 600 to fill up (and it’s tank is half the size!). Taxes, when you factor in indirect taxation, are much lower in China than in most European countries.

You get the picture, if you don’t have an army of Children in international schools in China, the cost of living is cheap; and even more for the many Chinese who invested in down-town property developments 10-15 years ago for a 20th of the current prices, when the developers were enticing people to pool their family money (and so created a slew of dollar millionaires in the process). And then there’s the family. Chinese people are very skilled at sharing their wealth within their extended families to facilitate property purchases and other investments; there is a group attitude to wealth creation, and it often seems to have worked to many families’ advantage.